Convertible Bonds Advantages and Disadvantages

List of Advantages of Convertible Bonds. The Dangers of.

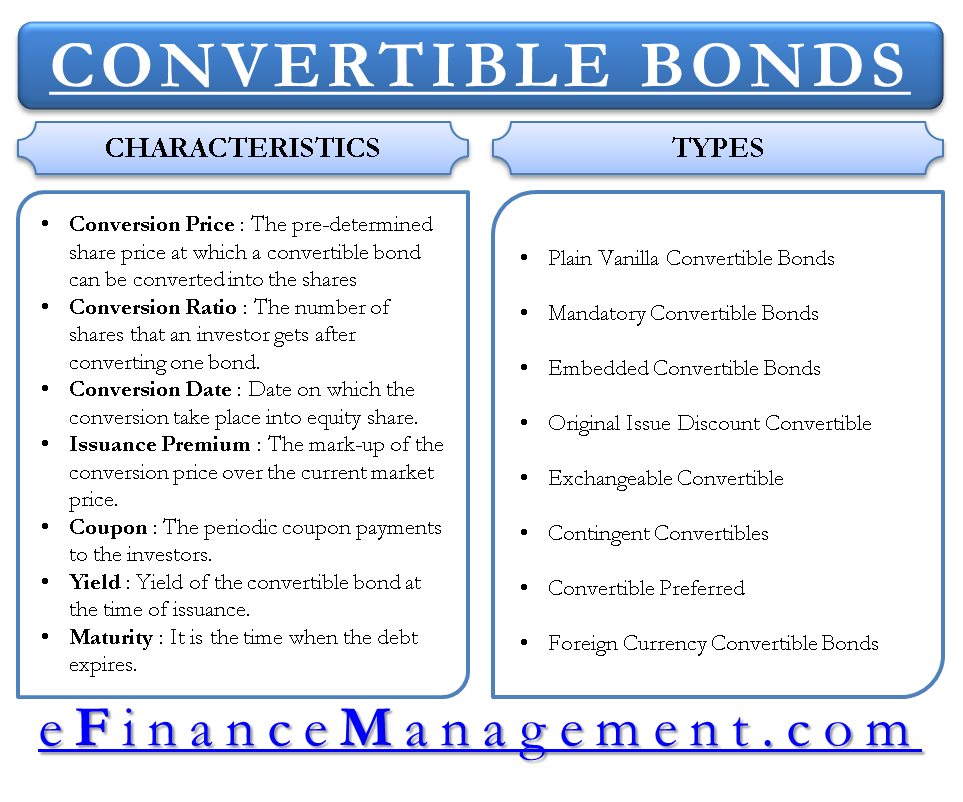

Convertible Bonds Efinancemanagement

Let us have a look at the advantages and disadvantages of leasing.

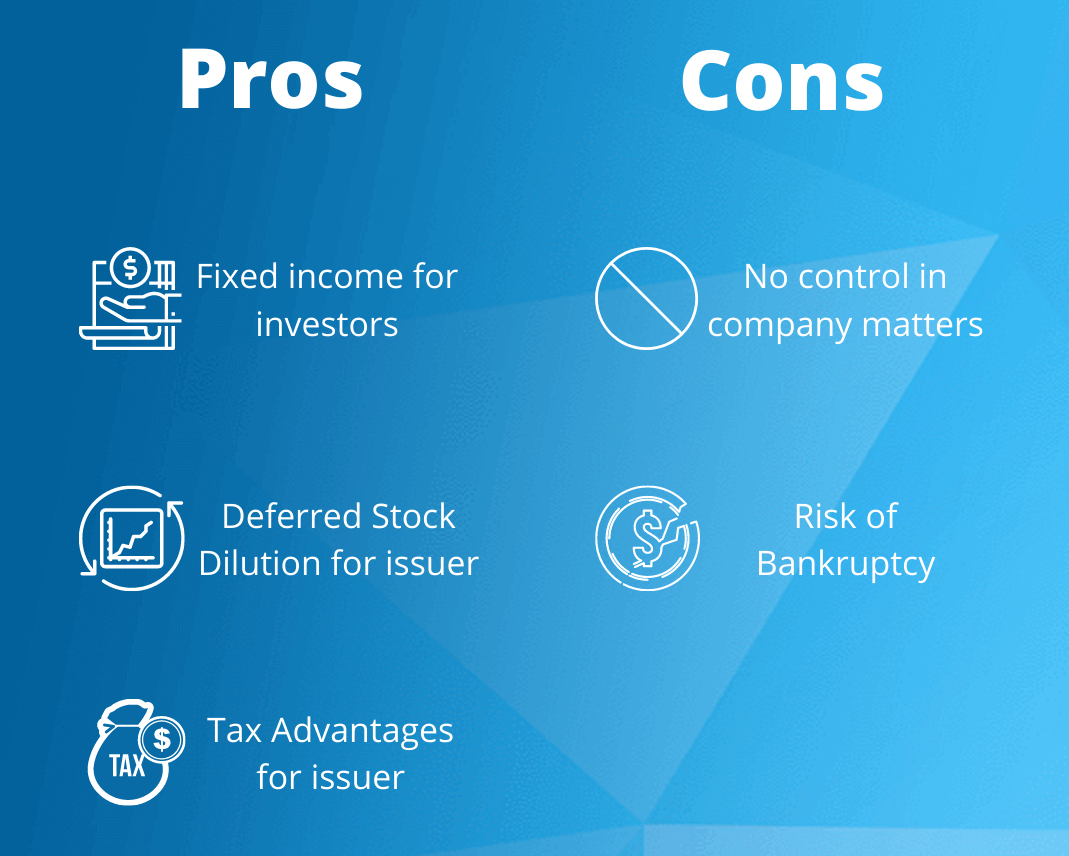

. This is an advantage. 19 Major Advantages and Disadvantages of Annuities. Regardless of how profitable the company is convertible bondholders receive only a fixed limited income until conversion.

A zero-coupon bond is a type of bond with no coupon. Different Types of Bonds Plain Vanilla Bonds. A financial instrument is a financial contract between two parties.

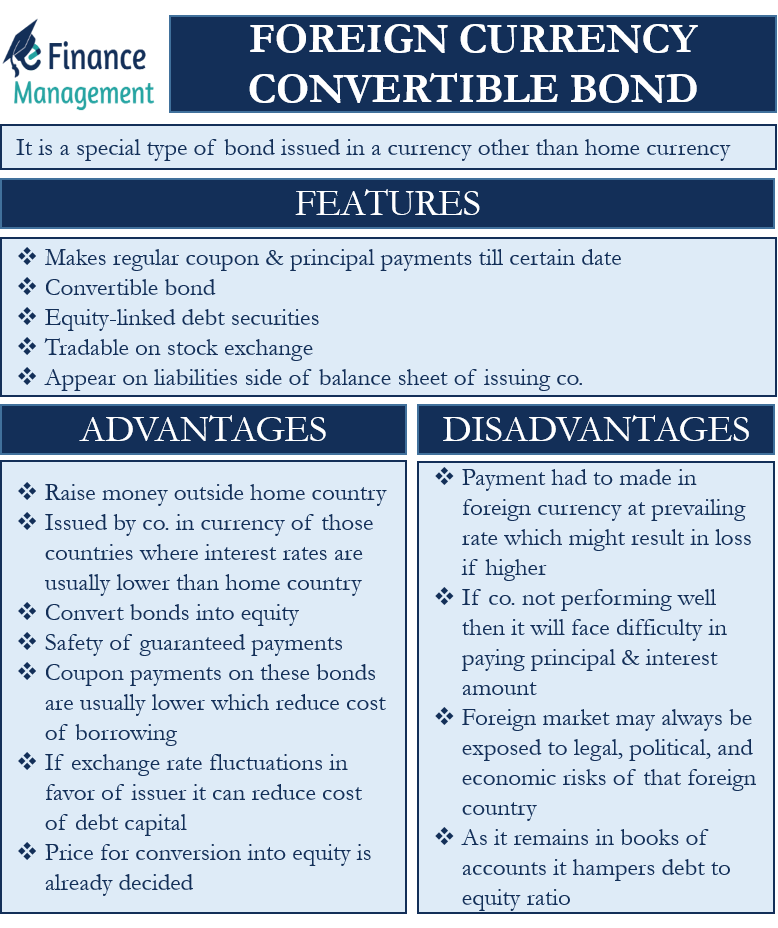

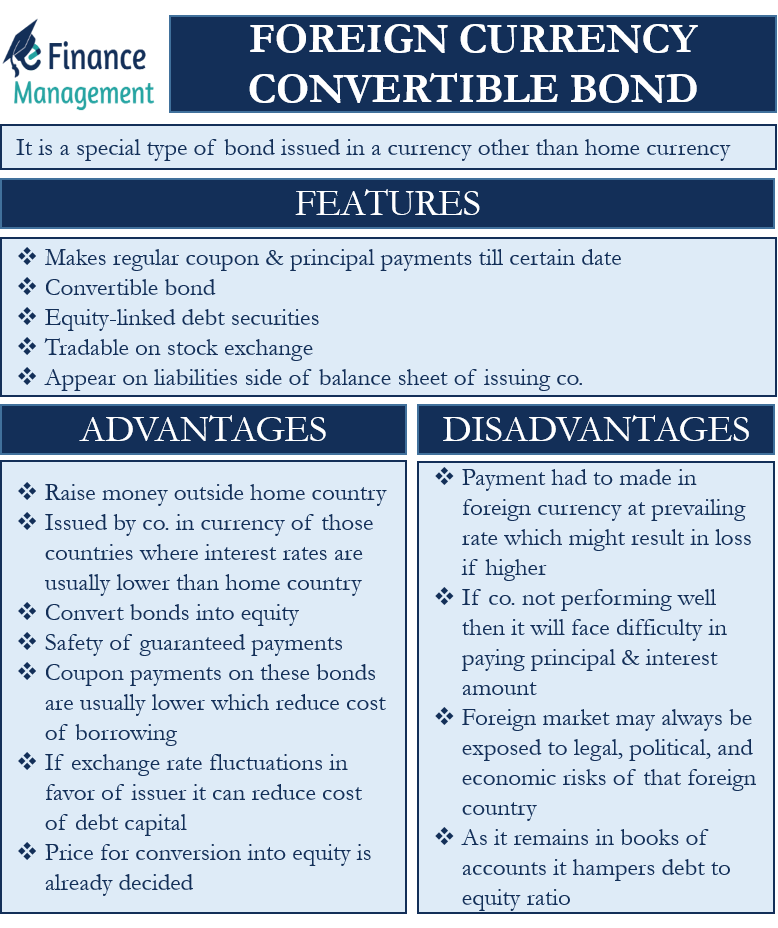

Advantages and Disadvantages of Leasing While evaluating this investment it is essential for the owner of the capital to understand whether leasing would yield better returns on capital or not. A convertible security is a financial instrument whose holder has the right to convert it into another security of the same issuer. Convertible bondholders receive only a fixed limited income until conversion.

By dividing 2000 by 10 the stockholder determines they will receive 200 shares of the issuers common stock. Example with convertible bonds. Examples of financial instruments are bills of.

Definition Examples. Advantages of Preference Shares Advantages of Preference Shares to Investors. If you hold preference shares of a company then you are entitled to earn fixed dividends as per pre-defined rates.

It is also known as a straight bond or a bullet bond. The conversion price for each stock share is 10. 17 Big Advantages and Disadvantages of Focus Groups.

It is a document that represents an asset to one party and liability to another. Most convertible securities are convertible bonds or preferred stocks that pay regular interest and can be converted into shares of the issuers common stockConvertible securities typically include other embedded options such as call or. Advantages of Debt Financing in Convertible Bonds.

Convertible Bonds in Accounting. The advantages and disadvantages of preferred stock have changed little over the years. Types of Financial Instruments.

17 Biggest Advantages. A gift of 10000 to be received in two years is worth 8900 today-You have 4500 saved while your sister has 5600 saved-Your grandmother promised to give you 15000 upon your graduation from college. It carries financial value and represents a binding agreement between two or more parties.

24 Key Advantages and Disadvantages of a C Corporation. The financing of the company by way of issuance convertible bonds must be apprehended in the light of its advantages and disadvantages before making the decision as. The Advantages of Bond Financing 519 How.

A stockholder has a convertible bond that has a par value of 2000. -A new convertible that you would like to buy costs 36800 today. This is a great advantage for the company because a bigger chunk of the operating income is available to the common stockholders.

Advantages Disadvantages Negotiated Transfer Pricing. 17 Key Advantages and Disadvantages of Corporate Bonds. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of goldThe gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold.

18 Advantages and Disadvantages of a Gated Community. These preference shareholders do not get the right to convert their preference shares into equity shares. The early rounds of investment may be in the form of convertible notes that go into preferred stock in a later round.

17 Key Advantages and Disadvantages of Corporate Bonds. A plain vanilla bond is a bond without unusual features. Definition Examples.

We would like to show you a description here but the site wont allow us. Here are examples of conversion ratios for different types of convertible securities. When convertible bonds are issued initially the market value of the shares into which the bonds will be convertible is always less than the market value of the convertibles.

It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is used by investors to predict future value. 16 Biggest Advantages and Disadvantages of Mediation.

If a company does well it has to share its operating income only with the newly converted. 19 Major Advantages and Disadvantages of Annuities. Like the price of bonds the price of convertible preferred shares will normally fall as interest rates go up since the fixed dividend looks.

Convertible Bond Everything You Need To Know Eqvista

Foreign Currency Convertible Bond Fccb

What Are Convertible Bonds Forbes Advisor

Convertible Bonds Primer On Conversion Features Of Debt Securities

No comments for "Convertible Bonds Advantages and Disadvantages"

Post a Comment